Pre-Owned Patek Philippe Nautilus Investment Strategy: Year-End Portfolio Planning for November 2025

As November 2025 unfolds and savvy investors turn their attention to year-end financial planning, the pre-owned luxury watch market—particularly Patek Philippe Nautilus timepieces—presents a compelling alternative asset class. For sophisticated collectors and investors seeking portfolio diversification, used Patek Philippe Nautilus watches offer tangible value retention, historical appreciation, and the enduring prestige of one of the world's most respected luxury watch brands. This strategic approach to holiday investment planning combines passion with prudence, allowing discerning individuals to acquire exceptional timepieces while potentially benefiting from the robust secondary market for pre-owned luxury watches.

The November holiday season traditionally marks a period of significant financial decision-making, from tax planning to asset allocation adjustments. In this context, Patek Philippe watches—especially the iconic Nautilus collection—have demonstrated remarkable resilience and appreciation potential. Unlike volatile securities or depreciating assets, these mechanical masterpieces embody Swiss horological excellence while functioning as portable stores of value that can be worn, enjoyed, and passed down through generations.

Understanding Pre-Owned Patek Philippe Nautilus as Portfolio Assets

The Patek Nautilus represents more than just a luxury timepiece; it embodies an investment-grade asset with proven historical performance. Introduced in 1976 by legendary designer Gérald Genta, the Nautilus revolutionized luxury sports watches with its distinctive porthole-inspired case and horizontal embossed dial. Today, certain references command premiums exceeding their original retail prices, with some vintage models appreciating exponentially over the decades. The scarcity of production, combined with Patek Philippe's uncompromising commitment to quality, creates a supply-demand dynamic that favors long-term value retention.

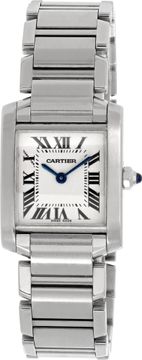

For November 2025 investment planning, the pre-owned market offers particular advantages. Unlike purchasing new timepieces at full retail, acquiring pre owned Patek Philippe watches allows investors to avoid initial depreciation while accessing references that may no longer be in production. The secondary market also provides greater price transparency and the opportunity to acquire pieces with established provenance and market track records. At Gray & Sons, our curated selection includes exceptional examples like the Patek Philippe Nautilus 3800 in 18k and stainless steel, a 37.5mm automatic watch priced at $68,000 that exemplifies the marriage of precious metals and sports watch functionality.

The Investment Case for Luxury Watches in Year-End Planning

As tax year 2025 draws to a close, high-net-worth individuals increasingly recognize luxury watches as alternative investments that offer both aesthetic pleasure and financial benefit. Unlike traditional investments subject to capital gains reporting when sold, luxury watches function as personal property with unique tax treatment. Furthermore, these tangible assets provide portfolio diversification away from correlated stock and bond markets, offering a hedge against inflation while delivering daily utility and enjoyment.

The November timeframe proves particularly strategic for several reasons. Year-end financial reviews often reveal opportunities to deploy capital into assets that can be enjoyed immediately while potentially appreciating over time. Additionally, the holiday season inspires thoughtful gift-giving, and a Patek Philippe watch represents an heirloom-quality present that transcends ordinary luxury goods. Consider complementing your timepiece acquisition with distinctive accessories like the exquisite Patek Philippe Nautilus Dial Motiff Cufflinks in 18k White Gold, priced at $5,250—a sophisticated way to express your appreciation for Nautilus design elements in everyday business attire.

Used Patek Philippe watches continue demonstrating remarkable resilience in secondary markets, with certain discontinued references commanding premiums that reflect their scarcity and desirability. This phenomenon particularly affects the Nautilus collection, where production limitations and design discontinuations create immediate appreciation potential for fortunate owners.

Featured Investment-Grade Patek Philippe Timepieces for November 2025

Gray & Sons' current inventory showcases several exceptional Patek Philippe watches that merit consideration for year-end portfolio enhancement. Beyond the Nautilus collection, our selection includes timeless classics that exemplify the manufacture's commitment to excellence across diverse complications and aesthetics.

The Patek Philippe Calatrava 5227R in 18k rose gold presents a sophisticated alternative for investors seeking understated elegance. This 39mm automatic watch, featuring an ivory dial and priced at $34,900, represents the epitome of dress watch perfection. The Calatrava collection's enduring design language and mechanical sophistication have sustained value appreciation for decades, making it an excellent complement to sport models in a well-rounded watch portfolio.

For collectors appreciating vintage horological treasures, the Patek Philippe Calatrava 3445 in 18k yellow gold offers entry into Patek ownership at $18,000. This 35mm automatic watch embodies the refined proportions and timeless aesthetics that characterized mid-century watchmaking, when craftsmanship prioritized perfection over marketing. Vintage Patek Philippe pieces have demonstrated particularly strong appreciation trajectories, especially references with well-documented provenance and excellent preservation.

Another compelling option for the discerning collector is the Patek Philippe Classic 18k yellow gold ref-3879/1, available at $18,500. This piece represents the manufacturer's commitment to classic design principles while offering accessibility to the brand's prestigious heritage. Such vintage watches often appreciate steadily as collectors recognize their historical significance and increasing scarcity.

Comparing Patek Philippe with Other Luxury Watch Brands

While Patek Philippe commands premium positioning within the horological hierarchy, strategic investors recognize value across multiple luxury watch brands. The used Rolex market, for instance, offers exceptional liquidity and brand recognition, with certain sport models demonstrating remarkable price stability. Gray & Sons maintains an extensive selection of pre owned Rolex timepieces, including iconic references like the Rolex Submariner 16610 in stainless steel, priced at $11,500—an accessible entry point for luxury watch investment.

The Rolex brand's widespread recognition and robust secondary market infrastructure provide investors with enhanced liquidity compared to smaller manufactures. Models like the Rolex Submariner 16618 in 18k yellow gold, offered at $37,500 with box and papers, combine precious metal content with the brand's legendary dive watch credentials. For those interested in used Rolex watches, our comprehensive selection spans vintage treasures to contemporary references, ensuring options for diverse investment strategies and aesthetic preferences.

Beyond these two dominant brands, our curated inventory includes exceptional pieces from other prestigious manufacturers. The Gerald Genta Retro g3632 in 18k rose gold, featuring a mother-of-pearl dial and priced at $18,500, represents the visionary work of the designer who created both the Nautilus and Audemars Piguet Royal Oak. Such pieces offer collectors the opportunity to own works by horological legends while potentially benefiting from increasing recognition of Genta's broader contributions to watch design.

Year-End Tax Considerations and Strategic Acquisition Timing

November 2025 presents optimal timing for luxury watch acquisitions from both enjoyment and financial planning perspectives. Unlike securities transactions that may trigger immediate capital gains recognition, personal property purchases offer different tax treatment that sophisticated investors leverage for portfolio optimization. While we always recommend consulting qualified tax professionals regarding individual circumstances, understanding the broader framework helps inform strategic decision-making.

The holiday season additionally provides natural gifting opportunities, allowing the joy of luxury watch ownership to be shared with loved ones. A Patek Philippe or high-quality used Rolex represents a gift that appreciates emotionally while potentially maintaining or increasing financial value—a combination rarely achieved with conventional presents. Consider the Rolex Datejust 116233 in stainless steel, featuring a champagne dial and offered with box and papers at $12,950, as an elegant choice for marking significant personal or professional milestones.

For clients in major metropolitan markets from Las Vegas to Phoenix, and throughout Florida from Orlando to Fort Lauderdale and West Palm Beach, Gray & Sons provides access to investment-grade timepieces with the confidence that comes from our 45-year reputation for excellence. Our master watchmakers meticulously inspect every piece, ensuring authenticity and optimal mechanical performance before entering our inventory.

Building a Diversified Watch Portfolio

Strategic watch collectors recognize the importance of diversification within their horological holdings. Just as financial advisors recommend balanced portfolios across asset classes, experienced watch investors acquire pieces spanning different brands, complications, materials, and style categories. This approach mitigates risk while ensuring collections remain relevant as market preferences evolve and individual tastes mature.

A well-constructed watch portfolio might include a cornerstone Patek Philippe Nautilus for prestige and investment potential, complemented by versatile Rolex Datejust pieces for everyday wear, and perhaps vintage treasures that offer historical significance and conversation value. Gray & Sons' selection includes exceptional examples across all these categories, from the accessible Rolex Datejust 1600 in 14k and stainless steel at $4,950 to extraordinary complications and limited editions.

For those seeking distinctive pieces beyond mainstream brands, consider treasures like the Piaget Polo 7131 c 701 in 18k gold, a 25mm quartz watch priced at $18,500 that exemplifies the elegance of integrated bracelet sport watches from alternative manufactures. Similarly, the Corum Trapeze 82.404.56 in 18k gold at $12,900 offers a bold 40mm automatic movement housed in distinctive styling that stands apart from conventional round cases.

The Gray & Sons Advantage: Expertise, Authentication, and Service

Acquiring investment-grade timepieces requires partnering with established dealers who guarantee authenticity and provide comprehensive after-sale support. Gray & Sons Jewelers, established in 1980, has built an unparalleled reputation for offering meticulously inspected, certified pre-owned watches and estate jewelry. Our team of master-trained watchmakers and expert jewelers ensures every timepiece meets exacting standards before entering our inventory, providing clients with absolute confidence in their acquisitions.

Our Surfside, Florida showroom, conveniently located across from the iconic Bal Harbour Shops, welcomes collectors to experience our curated selection firsthand. While our extensive digital catalog provides convenient browsing, nothing replaces the experience of examining these mechanical masterpieces in person, feeling their weight and appreciating the craftsmanship that distinguishes truly exceptional timepieces. For those unable to visit our showroom, we invite you to request a physical catalog or subscribe to our newsletter to stay informed about new arrivals and market insights.

Beyond sales, Gray & Sons offers comprehensive watch repair and jewelry repair services, ensuring your investments remain in optimal condition for decades to come. Our master watchmakers possess the expertise to service even the most complicated Patek Philippe movements, providing maintenance that preserves both functionality and value. This vertically integrated approach—combining acquisition, authentication, and ongoing service—distinguishes Gray & Sons as the premier destination for serious watch collectors and investors.

Conclusion: Strategic Action for November 2025 Investment Planning

As November 2025 progresses and year-end planning accelerates, discerning investors recognize the unique advantages of incorporating pre-owned Patek Philippe Nautilus watches and other investment-grade timepieces into diversified portfolios. These mechanical masterpieces transcend conventional luxury goods, functioning as tangible assets that deliver daily enjoyment while potentially appreciating over time. The current market presents exceptional opportunities across price points, from accessible entry pieces to extraordinary complications worthy of museum collections.

The strategic timing of November acquisitions combines practical financial planning with the emotional resonance of holiday celebrations and year-end reflection. Whether acquiring a cornerstone Patek Philippe for personal wear, gifting a beloved used Rolex to mark significant achievements, or diversifying existing portfolios with carefully selected pieces from prestigious manufactures, the time to act is now. Exceptional timepieces—particularly sought-after references in the Nautilus collection—remain subject to market dynamics that favor early acquisition over delayed decision-making.

Frequently Asked Questions

Why should I consider pre-owned Patek Philippe Nautilus watches as investment assets for November 2025 year-end planning?

Pre-owned Patek Philippe Nautilus watches represent tangible assets with proven appreciation potential, offering portfolio diversification away from traditional securities. The November timeframe provides strategic timing for year-end financial planning, allowing investors to acquire exceptional timepieces that can be enjoyed immediately while potentially maintaining or increasing value. Unlike new purchases at full retail, the pre-owned luxury watch market offers established price transparency and access to discontinued references with known market performance. Gray & Sons' curated selection, including pieces like the Patek Philippe Nautilus 3800 at $68,000, provides authenticated examples suitable for serious collectors and investors.

How do Patek Philippe watches compare to used Rolex timepieces for investment purposes?

Both brands offer compelling investment characteristics, though with different market dynamics. Patek Philippe commands premium positioning with lower production volumes and exceptional appreciation potential for select references, particularly within the Nautilus collection. Used Rolex watches provide superior liquidity due to widespread brand recognition and robust secondary market infrastructure. Many investors maintain positions in both brands, leveraging Patek Philippe's prestige and scarcity alongside Rolex's accessibility and market depth. Gray & Sons offers exceptional examples from both manufactures, allowing clients to construct diversified watch portfolios aligned with individual objectives and preferences.

What authentication and service support does Gray & Sons provide for investment-grade timepieces?

Gray & Sons' team of master-trained watchmakers meticulously inspects every timepiece for authenticity and optimal mechanical performance before it enters our inventory. While we guarantee the authenticity of all jewelry and watches we sell, we maintain the highest standards in workmanship and materials. Our comprehensive watch repair services ensure your investments remain in exceptional condition for decades, with expertise servicing even the most complicated movements from prestigious manufactures. This vertically integrated approach—combining acquisition, authentication, and ongoing maintenance—provides clients with complete confidence throughout their ownership experience.

Are pre-owned luxury watches subject to special tax considerations for year-end planning?

Luxury watches function as personal property with tax treatment that differs from securities and other financial instruments. Unlike stock sales that trigger immediate capital gains recognition, personal property acquisitions offer unique considerations that sophisticated investors leverage for portfolio optimization. However, tax regulations vary significantly based on individual circumstances, jurisdictions, and specific transaction structures. We strongly recommend consulting qualified tax professionals regarding your particular situation to understand implications and opportunities related to luxury watch investments. Our team focuses on providing exceptional timepieces and expert horological guidance while encouraging clients to work with appropriate advisors for tax planning.

How can I view Gray & Sons' complete selection of investment-grade Patek Philippe and Rolex watches?

We invite you to visit our Surfside, Florida showroom across from Bal Harbour Shops to experience our curated collection firsthand. For convenient remote browsing, explore our comprehensive digital catalog featuring detailed photographs and specifications for hundreds of exceptional timepieces. You may also request our physical catalog to be delivered to your home or office, or subscribe to our newsletter for regular updates about new arrivals and market insights. Our knowledgeable staff stands ready to assist with selection, authentication questions, and strategic acquisition guidance tailored to your collecting objectives and investment criteria.

Enhancing Your Luxury Experience with Gray & Sons

For 45 years, Gray & Sons Jewelers has served discerning collectors seeking exceptional pre-owned luxury watches and fine jewelry. Our commitment to quality, authenticity, and client satisfaction has established us as South Florida's premier destination for investment-grade timepieces from the world's most respected manufactures. Whether you're building your first collection or adding to established holdings, our team provides the expertise and inventory selection to support your horological journey.

Beyond purchasing, Gray & Sons offers comprehensive services including professional watch repair, jewelry repair, and consignment opportunities for those looking to refresh their collections. Our sell or trade-in program provides competitive valuations for timepieces and jewelry you're ready to transition, ensuring you receive maximum value when updating your portfolio. This complete suite of services transforms Gray & Sons from a mere retailer into your lifelong partner in luxury watch collecting and investment.

Our inventory updates continuously with new arrivals spanning vintage Patek Philippe pieces, contemporary Rolex sport models, and exceptional timepieces from alternative manufactures that offer distinctive value propositions for sophisticated collectors. We invite you to explore our current selection, understanding that the most desirable pieces often find homes quickly among our discerning clientele.

Take Action on Your November 2025 Investment Strategy

The convergence of year-end planning season, holiday celebrations, and exceptional inventory availability creates a unique window of opportunity for luxury watch acquisitions. Don't delay in exploring how pre-owned Patek Philippe Nautilus watches and other investment-grade timepieces can enhance both your collection and your portfolio. Contact Gray & Sons today to discuss your collecting objectives, schedule a private viewing at our Surfside showroom, or begin exploring our extensive fine luxury watches collection online.

For those seeking immediate gratification combined with long-term investment potential, exceptional pieces like our featured Nautilus and Calatrava references won't remain available indefinitely. The November 2025 luxury watch market rewards decisive action, particularly for sought-after references from the world's most prestigious manufactures. Allow Gray & Sons' 45 years of expertise to guide your acquisition decisions, ensuring every timepiece you acquire meets the exacting standards that distinguish true investment-grade pieces from ordinary luxury goods.

Explore our complete selection of used Patek Philippe watches, discover exceptional pre-owned Rolex timepieces, or visit our Surfside showroom to experience the Gray & Sons difference firsthand. Your next horological treasure awaits—secure it before year-end.

Exquisite Pre-Owned Rolex Watches and GIA Diamond Jewelry: November 8, 2025 New Arrivals at Gray and Sons

NEXT ARTICLE

Pre-Owned Luxury Watches and Fine Jewelry: New Arrivals at Gray and Sons – November 7, 2025